Examining the Powerful RSI Indicator:

A Trader’s Tutorial

The Relative Strength Index (RSI) is a cornerstone tool in a trader’s arsenal. Developed by J. Welles Wilder Jr., the RSI helps gauge an asset’s momentum and identify potential overbought or oversold conditions. This tutorial will dissect the RSI, explore its mechanics, and delve into how traders use it, along with expert insights.

Unveiling the Formula:

The RSI sits between 0 and 100, reflecting the relative strength of recent price movements. Here’s the magic under the hood:

- Average Gain/Loss: The RSI considers average gains and losses over a specified period (typically 14 days). It calculates the Average Gain (AG) for up days and the Average Loss (AL) for down days.

- Relative Strength: To account for price fluctuations, the RSI uses the Relative Strength (RS) which is the ratio between the AG and the AL smoothed by a factor (often set to 1). The formula:

RS = AG / (1 – AL)

Smoothing the Ride: Raw RS can be volatile. The RSI applies a smoothing factor to create a more manageable value. A common approach is using the prior day’s RSI value and the current RS to calculate a new RSI:

RSI = (Prev RSI) + (1 – (Prev RSI)) * RS

Applying the RSI:

Now that you understand the mechanics, let’s see the RSI in action:

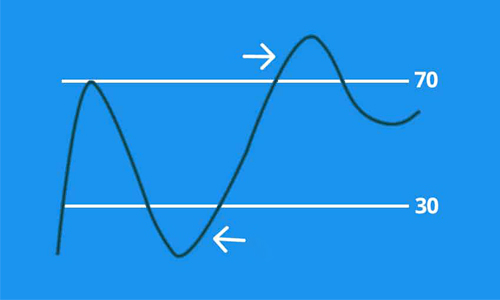

- Overbought/Oversold Levels: Traditionally, readings above 70 suggest an overbought condition, and values below 30 indicate an oversold condition. These levels may need adjustment based on the specific asset and market conditions.

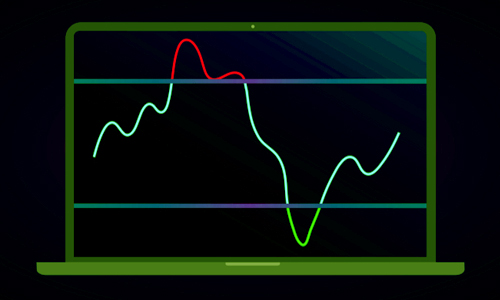

- Divergences: When the price makes a new high but the RSI fails to follow suit (bearish divergence), it can signal a potential reversal. Conversely, a price making a new low while the RSI doesn’t (bullish divergence) can hint at an upcoming upside move.

- Trend Confirmation: The RSI can be used alongside trend indicators. For example, during an uptrend, the RSI should ideally stay above 30 and frequently touch 70. Conversely, in a downtrend, the RSI rarely surpasses 70.

Combining RSI with Other Indicators for Stronger Signals

The RSI is a powerful tool, but it can benefit from being used alongside other technical indicators. Here are some popular combination strategies to consider:

1. RSI and Moving Averages:

Confirmation of Trend:

- Combine RSI with a short-term moving average (e.g., 50-period) and a long-term moving average (e.g., 200-period).

- In an uptrend, look for the RSI to stay above 50 and the short-term moving average to cross above the long-term moving average (bullish crossover). This strengthens the uptrend signal.

- Conversely, in a downtrend, look for the RSI below 50 and a bearish crossover (short-term moving average falls below the long-term moving average).

2. RSI and Support/Resistance:

Overbought/Oversold at Key Levels:

- Identify support and resistance levels on the price chart.

- If the RSI reaches overbought territory (above 70) near a resistance level, it might indicate a stronger chance of a price reversal to the downside.

- Conversely, an oversold RSI (below 30) near a support level could suggest a potential price bounce.

3. RSI and Divergence:

Identifying Trend Reversals:

- This strategy focuses on the divergence between the RSI and price movement.

- If the price makes a new high but the RSI fails to reach a new high (bearish divergence), it suggests weakening bullish momentum and a possible trend reversal.

- Conversely, if the price makes a new low but the RSI doesn’t reach a new low (bullish divergence), it could signal strengthening bullish momentum and a potential trend reversal.

4. RSI with Stochastic Oscillator:

Dual Momentum Indicator: Both RSI and Stochastic Oscillator measure momentum. When they both signal overbought (or oversold) conditions, it strengthens the confidence in the signal.

Remember:

- These are just a few examples, and there are many other combinations you can explore.

- Backtest any strategy on historical data before deploying it with real capital.

The Experts Weigh In

While the RSI is a valuable tool, here’s what the experts have to say:

- False Signals: The RSI can generate false signals in strong trends. Be mindful of the prevailing trend when interpreting RSI readings.

- Not a Standalone Tool: The RSI should be used in conjunction with other technical indicators and fundamental analysis for a well-rounded trading strategy.

- Overbought/Oversold Levels Aren’t Fixed: These thresholds can vary depending on the asset and market context. Backtesting can help identify the most relevant levels for your specific strategy.

The Bottom Line

By understanding the structure, interpretation and limitations of the RSI, traders can use this powerful tool to make informed trading decisions. Remember, RSI is a valuable piece of the puzzle, not the whole picture, and with proper risk management practices is very applicable to any trading strategy.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Happy trading

may the pips be ever in your favor!