Candlesticks Unveiled:

Their Essential Role in Forex Technical Analysis

Candlestick charts, originating in 18th-century Japan, have become a near-universal tool for technical traders in the Forex market. Their ability to visually condense price action into easily interpreted patterns offers traders a distinct advantage over traditional line or bar charts. Understanding these patterns is essential for any trader looking to master the intricacies of Forex market dynamics.

What are Candlesticks?

Japanese rice traders perfected candlestick charts in the 1700s. Each candlestick represents a specific timeframe and visually encapsulates four crucial price points:

- Open: The first traded price for the period

- High: The highest traded price for the period

- Low: The lowest traded price for the period

- Close: The last traded price for the period

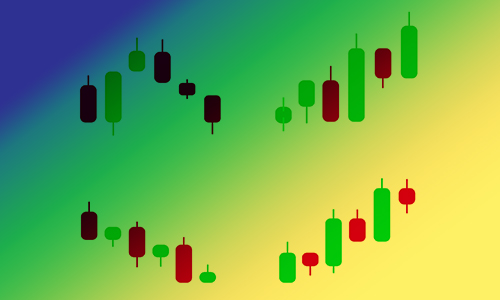

The candlestick’s “body” is formed between the open and close price. If the close is higher than the open, the body is typically filled in green or white, indicating a bullish period. If the close is lower than the open, the body is typically filled in red or black, signaling a bearish period. The thin lines extending above and below the body are “wicks” or “shadows”, representing the high and the low prices.

Unlocking Market Psychology with Candlesticks

Notably, candlesticks don’t just display raw price data; they reflect trader psychology. The size of the body, the length of the wicks, and the formations created by multiple candlesticks provide clues about buyers’ and sellers’ mindsets.

Why Candlesticks Matter

- At-a-glance information: Candlesticks pack a wealth of information into a single visual element. The body of the candle illustrates the opening and closing prices for a given time period. The thin lines, known as wicks or shadows, show the highest and lowest prices reached during that time.

- Visualizing price action: Candlesticks effectively convey the intensity of buying or selling pressure. A long green candle implies strong bullish momentum, while a long red candle indicates dominant bear pressure.

- Revealing market psychology: Candlestick patterns reflect the collective emotions of traders – fear, greed, indecision, and conviction. By identifying these patterns, traders can gain insights into the prevailing market sentiment.

Great Traders on Candlesticks

Legendary traders have consistently advocated the power of candlestick analysis:

- Steve Nison, the ‘Father of Candlesticks’ in the West: Nison is credited with introducing Japanese candlestick charting to Western traders. He emphasizes their ability to reveal turning points in the market.

- Linda Raschke, renowned trader and market educator: Raschke underscores the significance of candlestick patterns in conjunction with other technical analysis tools for identifying profitable trading setups.

- Renowned trader George Soros has also acknowledged the value of patterns, indicating they offer insights into potential turning points and market imbalances.

- Jack D. Schwager (author of “Market Wizards“): “Candlestick patterns add an important dimension to technical analysis in pinpointing potential market turns”

Candlesticks in Action: Trading Strategies

Let’s delve into a few examples of how candlestick patterns are used in Forex trading strategies:

- The Hammer: A bullish reversal pattern with a long lower wick and a small body indicating a rejection of lower prices. Its appearance often signals a potential change in trend from bearish to bullish.

- Engulfing Pattern: A two-candle pattern where the second candle completely engulfs the real body of the first. A bullish engulfing pattern (green candle follows red) suggests a possible trend reversal and potential for buying opportunities.

- Doji: A candlestick with little to no real body and long wicks signifies indecision in the market. Doji’s can indicate uncertainty or a pause before a potential change in direction.

Key Points to Consider

- No single pattern is infallible: always combine candlesticks with other technical indicators (volume, moving averages, etc.), economic events and trading sessions to get a better context and strengthen your trade entry and exit signals.

- Context is key: The time frame in which a candlestick pattern forms matters. A Doji on a 5-minute chart might carry less significance than one formed on a daily chart.

- Risk management is paramount: Technical analysis, however powerful, does not guarantee success. Always deploy sound risk management strategies to protect your capital.

Important Considerations

While candlesticks are powerful, they’re not crystal balls. Always analyze patterns within the broader market context. Combine candlesticks with other technical indicators like volume, moving averages, and oscillators for greater confirmation.

Conclusion

Mastering candlesticks is a rite of passage for many Forex traders. Their visual simplicity combined with their ability to illuminate market sentiment makes them an indispensable tool. Remember, practice and observation are key to truly harnessing their power. As you deepen your understanding, candlestick patterns will become your trusted guide in the ever-evolving world of Forex.

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, levels of experience, and risk tolerance.

Happy trading

may the pips be ever in your favor!

One Comment

Hi there! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community in the same niche. Your blog provided us beneficial information to work on. You have done a marvellous job!