Weekly Technical and Fundamental Analysis of Gold – February 18th

Last week, the global gold ounce experienced a decline for the second consecutive week; the main factor that led to the decline in gold was the increase in the yield rate of the 10-year US Treasury bonds and the subsequent strengthening of the US dollar.

Now, in the upcoming week, all eyes are on the Purchasing Managers’ Index (PMI) report for February in the US and the first official meeting of the Federal Reserve Committee members in 2024.

Remember that whether the important level of $2000 can maintain itself as a very critical zone depends on gold’s reaction to the important data and events of the upcoming week.

Events in the gold market last week:

Last Monday, at the beginning of the working week, global gold, after opening at $2024, started to decline to around $2011. Since investors were waiting for the very important Consumer Price Index (CPI) report (which was scheduled to be released on Tuesday), they refrained from entering large positions and patiently waited for the inflation report on Tuesday.

The US Bureau of Labor Statistics reported on Tuesday that the Consumer Price Index had increased by 3.1% in January. It is worth mentioning that the market was expecting a figure of 2.9%, so the announced number was significantly higher than market expectations.

In addition, the Core CPI, which excludes food and energy items, also increased by 3.9% to match December’s figure.

Since according to the famous forecasting tool CME Group, the likelihood of the Federal Reserve leaving its interest rates unchanged in the next two policy meetings after the CPI data exceeded 60%, the yield rate of US Treasury 10-year bonds increased to over 4.3%, and gold plummeted below $2000 for the first time in 2024!

The US Dollar Index also decreased after a 0.7% increase following the inflation news on Wednesday and closed in negative territory. The global gold ounce also experienced a sharp decline on the same day after fluctuating around $1990 in a small range on Tuesday.

Then on Thursday, the day the market was waiting for the US Retail Sales report, US data showed that retail sales had decreased by 0.8% in January, reaching $700.3 billion. Additionally, the sales of used cars also decreased by 0.6% during the same period.

The yield rate of US Treasury 10-year bonds immediately dropped to 4.2% after disappointing data, causing global gold to return above $2000 in the second half of Friday and during the New York session.

Immediately after this report, Michael Barr, Vice Chair of Supervision at the Federal Reserve, commented on inflation-related data, stating that central bank policymakers are confident that inflation is on track to reach the 2% target. Barr also added that before starting the process of reducing interest rates, he and his colleagues need to see “more positive data.”

Finally, Friday arrived, the day the market was waiting for the Producer Price Index (PPI) report or PPI inflation index.

The BLS announced that the Producer Price Index (PPI) for final demand increased by 0.9% annually in January.

The figure announced was lower than the previous 1% but better than the market’s predicted 0.6% figure.

Additionally, the annual Core PPI index also increased by 2% compared to a 1.8% increase in December.

The monthly net PPI index also increased by 0.5% after a 0.1% decrease in the previous month.

After the release of this data, gold was unable to continue its upward trend on Thursday due to the return of the US Treasury 10-year bond yield rate to over 4.3%.

Events in the Forex and gold market next week:

Keep in mind that next Monday, with the start of the Forex trading week, the stock and bond markets in the United States will be closed due to Presidents’ Day.

On Wednesday, the Federal Reserve is scheduled to release its first meeting of 2024, which took place on January 30th and 31st.

As you are aware, the Federal Reserve typically releases the minutes of its meetings (which essentially describe what happened in that meeting) two weeks after their meetings.

If you remember, Federal Reserve Chairman Jerome Powell stated in a press conference after the January meeting that a rate cut in March is not likely. However, he also noted that unexpected weakness in the US labor market could prompt him and his colleagues to consider lowering rates sooner.

Following the important NFP report released after the January Fed meeting, investors were not only disappointed about the delay in rate cuts until March but also from May. This exact factor caused the long-term upward trend of gold in the daily timeframe to turn downwards and gold could not perform as expected.

Now, with important employment reports and the even more crucial US Consumer Price Index (CPI) indicating inflation in January, investors’ focus is on the June Fed meeting.

Therefore, it is unlikely that traders will be able to find new clues about the timing of rate cuts in future Federal Reserve meetings.

On Thursday, the S&P Global Institute is set to release preliminary PMI reports for manufacturing and services in the US for February.

Any unexpected weakening in private sector business activity, as indicated by a drop below the important 50 level in any of the PMI reports, could revive expectations for rate cuts in May and help XAU/USD move upwards again.

Keep in mind that influential members of the Federal Reserve may announce their opinions on the market following this important S&P survey.

Traders will carefully listen to these opinions, as their impact on the dollar and gold markets will be significant.

As this survey, like the NFP report, has various components, if it shows that inflation remains sticky in the US service sector, the US dollar can maintain its strength against its competitors and limit the rise of global gold, even if disappointing PMI figures are released.

Weekly Technical Analysis of Gold:

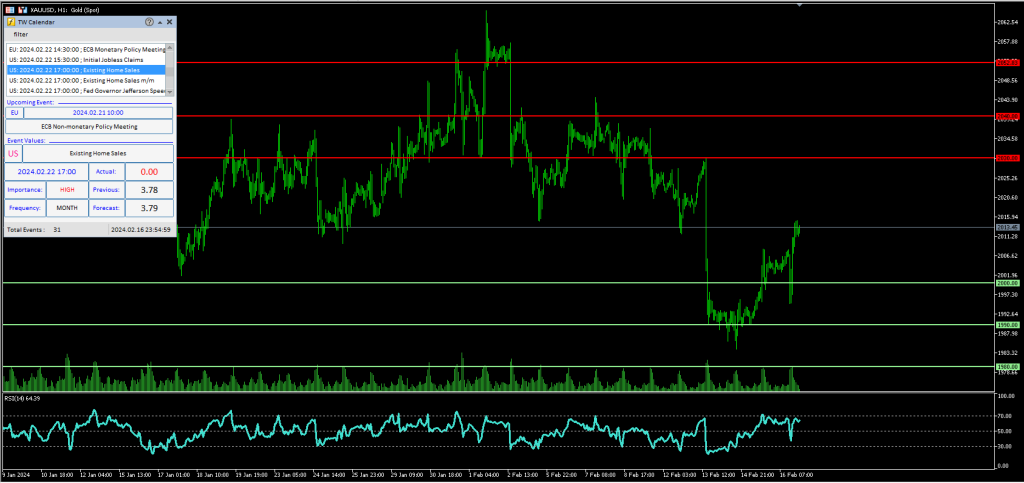

The price floor and ceiling of gold last week were 1984 and 2031. If you open a daily gold chart right now and plot an RSI indicator, you will see that the tip of this indicator is pointing upwards and showing a value of 46.

This means that currently, the market bulls are in control, but remember that the important 50-day moving average, which has acted as a strong support level for global gold for several months, has shifted above the current gold price.

If gold cannot maintain its important support level next week, we can expect a change in the daily trend of global gold from bullish to bearish.

Key Support Levels in Global Gold Analysis:

If gold were to decline, its first significant support level would be the important $2000 area. If gold penetrates below this area, the next important price level would be $1990. If market bears push gold lower, the next important level would be $1980.

Key Resistance Levels in Global Gold Analysis:

If gold increases, its first significant resistance level would be $2020. If gold successfully crosses this area, the next important resistance level would be $2030. If market bulls manage to push the price of gold higher, the next resistance levels would be $2040 and $2050.

Disclaimer: This article is for educational purposes only and should not be considered financial advice.

Happy trading

may the pips be ever in your favor!