The Powerful Cloud: Unveiling Trends with Ichimoku

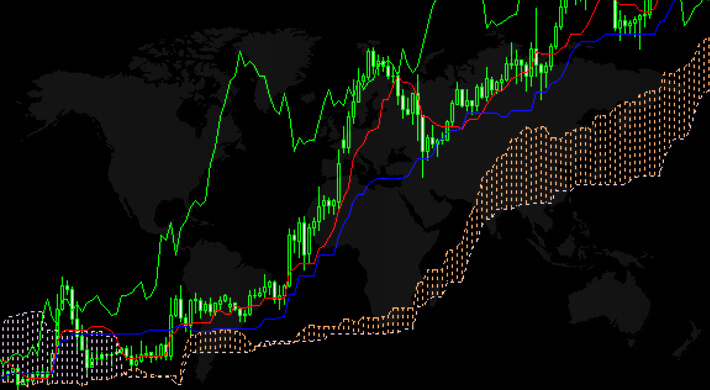

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo (translated as “equilibrium chart at a glance”), is a versatile technical analysis tool developed by Japanese journalist Goichi Hosoda in the 1930s. Unlike most indicators that focus on a single aspect of price movement, the Ichimoku Cloud is a multi-faceted wonder, offering insights into trend direction, support/resistance levels, and momentum – all on a single chart.

Decoding the Cloud’s Secrets:

At its core, the Ichimoku Cloud uses five lines derived from price points to analyze trends, support/resistance, and momentum. Here’s a breakdown of the calculations:

- Tenkan-sen (Conversion Line):

(Highest High + Lowest Low) / 2 of the past 9 periods (often days)

- Kijun-sen (Base Line):

(Highest High + Lowest Low) / 2 of the past 26 periods

- Senkou Span A (Leading Span A):

(Tenkan-sen + Kijun-sen) / 2, shifted forward by 26 periods

- Senkou Span B (Leading Span B): Highest High of the past 52 periods, shifted forward by 26 periods

- Chikou Span (Lagging Span): Closing price of the current period, shifted backward by 26 periods

- The Ichimoku Cloud itself is formed by the area between Senkou Span A and Senkou Span B.

Decoding the Cloud: How to Use the Ichimoku for Trading

The Ichimoku Cloud offers a multi-faceted approach to chart analysis. Here’s how to interpret its various elements:

Trend Direction:

- Upward Trend: Price is above the Cloud, with Tenkan-sen above Kijun-sen.

- Downward Trend: Price is below the Cloud, with Tenkan-sen below Kijun-sen.

- Flat Trend: Price is choppy and weaves in and out of the Cloud, with no clear direction from Tenkan-sen and Kijun-sen.

Support and Resistance:

- A thick Cloud indicates strong support or resistance.

- Price bouncing off the Cloud’s upper boundary suggests potential resistance.

- Price finding support at the Cloud’s lower boundary suggests potential support.

Momentum:

- Tenkan-sen and Kijun-sen crossover: A bullish crossover (Tenkan-sen rising above Kijun-sen) suggests potential buying pressure. A bearish crossover (Tenkan-sen falling below Kijun-sen) suggests potential selling pressure.

- Chikou Span: Its position relative to price action can indicate momentum. When Chikou Span is above price bars, it suggests potential bullish momentum. Conversely, when it’s below price bars, it suggests potential bearish momentum.

Traders’ opinion about Ichimoku:

While there isn’t a record of widely publicized opinions from specific famous traders on the Ichimoku Cloud, there are general sentiments within the trading community:

Pros:

- All-in-one tool: Many traders appreciate how the Ichimoku Cloud condenses trend, support/resistance, and momentum into a single indicator, simplifying chart analysis.

- Trend Following: Traders who favor trend-following strategies find the Ichimoku Cloud’s trend identification capabilities valuable.

Cons:

- Complexity: Beginners might find the Ichimoku Cloud overwhelming due to its multiple lines and calculations.

- False Signals: Like any technical indicator, the Ichimoku Cloud can generate false signals, especially in choppy markets.

Remember:

The Ichimoku Cloud is a complex tool, and these are general interpretations. Combining it with other technical indicators can strengthen your analysis.

Backtest your Ichimoku strategies on historical data to understand their effectiveness before deploying them in live trades.

By understanding the Ichimoku Cloud’s components and how they interact, you can gain valuable insights into trends, support/resistance levels, and momentum. However, it’s crucial to practice and combine it with other tools for a well-rounded trading strategy.

Further Exploration:

While this article provides an introduction, consider researching advanced Ichimoku strategies and backtesting them on historical data before implementing them in live trades.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Happy trading

may the pips be ever in your favor!