What is a Reasonable Profit in Forex?

Rethinking Your Goals for Sustainable Success

The allure of Forex trading lies in its potential for high returns. But seasoned traders know that chasing unrealistic profits often leads to reckless decisions and ultimately, losses. So, how much profit should you expect? This article dives into the concept of reasonable profit in Forex, exploring risk management, drawdown, and calculation methods to set you on the path of sustainable success.

Risk Management: The Bedrock of Reasonable Profits

Before chasing profits, Forex traders must prioritize risk management. This means employing strategies to limit potential losses on any given trade. Here are some key principles:

- Position Sizing: Only risk a small percentage (typically 1-2%) of your capital per trade. This ensures a single losing trade doesn’t wipe out your account.

- Stop-Loss Orders: Set stop-loss orders to automatically exit positions when the price moves against you, limiting potential losses.

- Drawdown: This is the peak-to-trough decline in your account value. Understanding your tolerance for drawdown helps you set realistic profit goals. Aiming for steady, consistent growth over chasing aggressive targets that risk larger drawdowns.

By implementing these practices, you focus on making consistent, smaller profits while protecting your capital.

Calculating Profits: Beyond Percentages

Many beginners focus solely on percentage gains. However, a more meaningful approach considers your account size and total dollar value of profits. For example, a 5% gain on a $1,000 account translates to $50, whereas a 2% gain on a $10,000 account yields $200.

Drawdown: Embracing the Inevitable

Every trading strategy experiences drawdowns, periods where your account value declines from a peak. Understanding and accepting drawdowns is crucial. A reasonable drawdown for a well-developed strategy might be 5-10%. However, exceeding this comfort zone may signal the need to adjust your strategy or risk management.

Profit Calculation Methods: Beyond Simple Percentage Gains

While percentage gains seem straightforward, they don’t consider the entire picture. Here are two alternative methods for a more nuanced view of your profitability:

- Sharpe Ratio: This metric compares your average return on investment (ROI) to the volatility (risk) of your trades. A higher Sharpe Ratio indicates better risk-adjusted performance.

- Kelly Criterion: This formula, used by some professional traders, calculates the optimal bet size based on your win rate, average win/loss ratio, and account balance. However, it’s a complex tool best suited for experienced traders with a deep understanding of risk management.

The Power of Valid Signals: Don’t Go It Alone

Even with a solid strategy, navigating the ever-shifting Forex market can be challenging. Consider incorporating valid trading signals into your approach. These signals, generated by technical analysis or fundamental factors, can provide valuable confirmation for your trades, potentially leading to higher win rates and improved profitability.

Valid signals should come from reputable sources with a proven track record. Always conduct your own research and use signals as a guide.

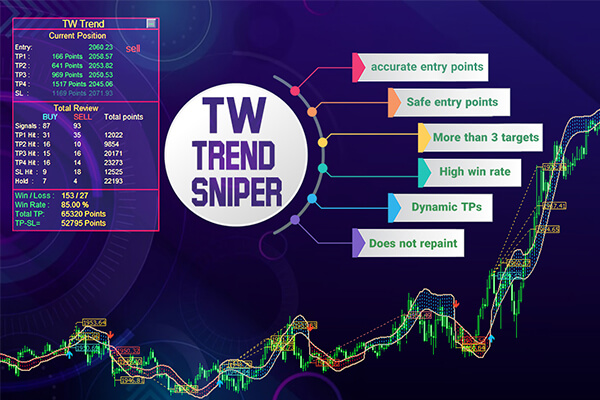

Introducing the “TW trend sniper” signal, a powerful indicator that is used to identify the main trends by using the “Trade Wizards” exclusive indicator formula along with the use of price action, the detection of currency trading sessions, Fibonacci and detection functions and artificial intelligence noise removal methods with high accuracy.

Remember:

Reasonable profit is about making consistent gains while managing risk. Focus on developing a sound strategy, using valid signals, and employing disciplined risk management. By prioritizing these aspects, you’ll be well on your way to achieving sustainable success in the world of Forex trading.

Happy trading

may the pips be ever in your favor!