Is the Gold Market Really Falling:

Decline and Strategies for Bearish Times

Gold, the traditional safe haven for investors during economic turmoil, has been experiencing a pullback in price recently. The question on everyone’s mind is whether this marks the beginning of a sustained decline, a bear market, or simply a temporary dip. To understand this, we need to delve deeper into the factors driving the price down. By dissecting these reasons, we can equip ourselves with the knowledge to navigate this potential bear market effectively. Utilizing the right trading signals can be crucial during such periods, allowing us to make informed decisions and potentially capitalize on opportunities that may arise.

Understanding the Decline

Several factors are contributing to the current softness in the gold market:

- Rising Interest Rates: As central banks raise rates to combat inflation, the opportunity cost of holding non-yielding gold increases. Investors seek assets that offer returns, putting downward pressure on gold.

- Stronger Dollar: A resurgent US dollar weakens the demand for gold, often seen as a hedge against a declining dollar.

- Shifting Investor Sentiment: With economic data showing signs of improvement, investors may be rotating out of safe-haven assets like gold and into riskier assets like stocks.

Bear market:

Bear market trading involves profiting in a declining market. Unlike a bull market where you buy low and sell high, here you might employ strategies like short selling (borrowing and selling a security hoping to buy it back cheaper) or using options contracts to profit if prices fall. However, bear market trading can be risky, so it’s important to have a strong understanding of the market and a tolerance for risk.

Trading in a Bear Market: Signals for Success

While the decline might be concerning, a bear market doesn’t have to spell doom for traders. Here’s how to leverage signals to navigate this potential shift:

- Technical Indicators: Technical indicators like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can identify overbought and oversold conditions. In a bear market, spotting oversold signals can indicate potential buying opportunities for a short-term bounce.

- Support and Resistance Levels: Identifying historical support levels where previous price declines were halted can indicate areas where the price may find temporary buying pressure again. Conversely, resistance levels can warn of selling pressure and potential price caps.

- Economic Data: Staying updated on economic data releases, particularly inflation figures and Federal Reserve pronouncements, can help anticipate future interest rate movements and their impact on the gold market.

- Gold-to-equity Ratio: Monitoring the ratio between gold prices and stock indices can offer insights into investor sentiment. A rising ratio might indicate a flight to safety, potentially foreshadowing a reversal in the gold price decline.

In fluctuations:

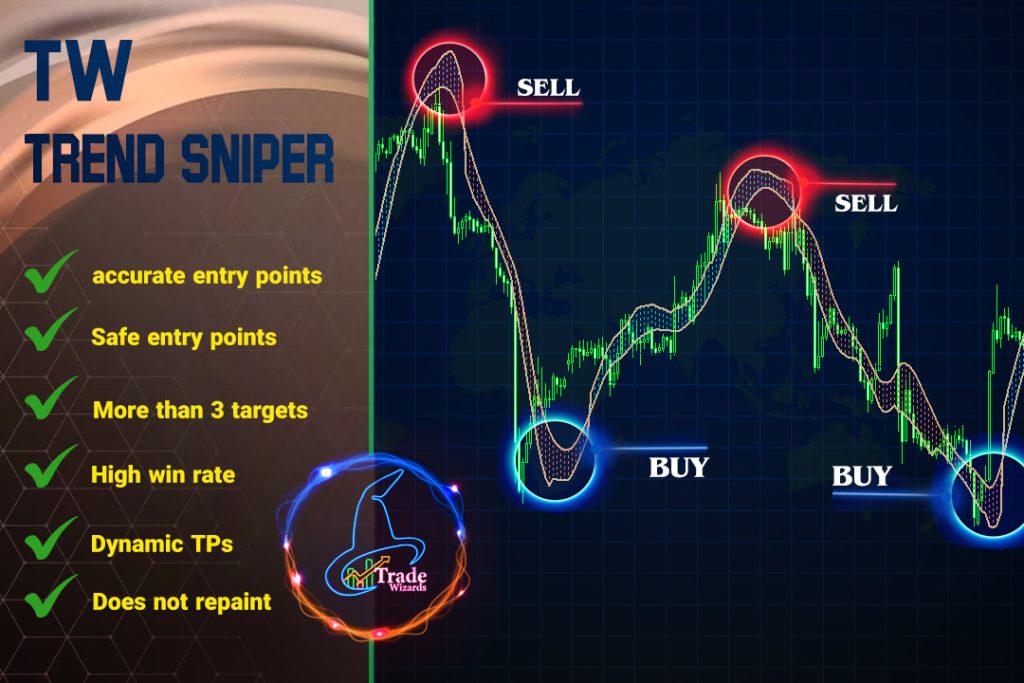

Even if the gold market declines further, check out the “TW trend Sniper” product. This all-in-one tool provides valuable signals through technical indicators, support/resistance levels and economic data, allowing you to potentially trade in bull markets by identifying buying opportunities during gold price declines and selling opportunities during market rallies. And make a profit.

Remember:

- Stay Disciplined: Stick to your trading plan and avoid emotional decisions.

- Manage Risk: Employ stop-loss orders to limit potential losses.

- Diversification is Key: Don’t overcommit to a bearish gold market. Maintain a diversified portfolio to hedge against risk.

Using a combination of these signals alongside sound risk management practices is crucial for successful trading in a bear market.

The gold market’s future trajectory remains uncertain. However, by understanding the causes of the decline and by strategically utilizing various signals, traders can position themselves to capitalize on potential opportunities in this evolving market landscape.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Happy trading

may the pips be ever in your favor!