Trading in the Twilight Zone:

Navigating the Forex Market Paradox

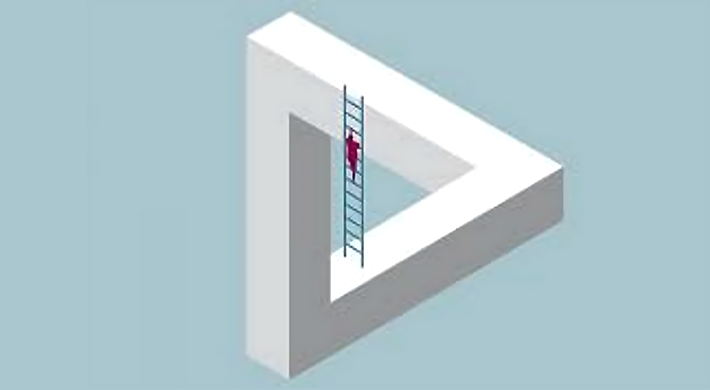

The foreign exchange market, a $6 trillion daily ballet of currency pairs, pulsates with opportunities and enigmas. While fundamentals set the stage, the dance floor is often commandeered by a troupe of unexpected guests: market sentiment, fear, and irrationality. This, dear trader, is the “Forex Market Paradox,” a labyrinth where logic and chaos waltz, and where capital management, psychology, and personal strategy become the keys to navigating the maze.

Demystifying the Paradox:

Imagine a world where robust US economic data leads to a weaker dollar, or where a central bank’s rate hike ignites currency depreciation. This is the paradox in action. Fundamentals, often hailed as the conductors of exchange rate symphonies, can be drowned out by crescendos of risk aversion, herd mentality, and knee-jerk reactions. Geopolitical tremors can trigger panicked exits, while a cryptic tweet can send currencies soaring. It’s enough to make even the most seasoned forex veterans question their compass.

Capital Management: Your Guiding Star:

In this volatile labyrinth, capital management becomes your North Star. It’s the art of allocating, protecting, and nurturing your precious pips. Remember, the forex market is a marathon, not a sprint. Aggressive forays might yield fleeting gains, but they’re a recipe for long-term ruin. Embrace risk-reward ratios that favor capital preservation, diversify across pairs and currencies, and resist the siren song of chasing losses. Your account will reward your prudence.

Conquering the Inner Demons: Mastering Psychology:

The paradox thrives on fear and greed, potent emotions that can warp your judgment and lead you astray. Fear can trigger premature exits from profitable positions, while greed can lure you into overleveraging and chasing mirages. To tame these demons, cultivate a stoic mindset. Develop a trading plan based on your risk tolerance and adhere to it, regardless of the market’s histrionics. Remember, every trade is a skirmish, and discipline is your shield.

Forex opportunities: Personal Strategy in the Labyrinth

The paradox offers a kaleidoscope of trading styles, from scalping’s rapid sprints to swing trading’s measured marches. Choose the one that resonates with your temperament and risk appetite. Backtest and refine your strategies, but remain adaptable to the market’s ever-shifting currents. The key is to forge your own unique blend of technical analysis, fundamental awareness, and a dash of intuition. Remember, the market whispers its secrets to those who listen intently.

In Conclusion:

The forex market paradox is not an anomaly, but a defining characteristic. It’s what separates the seasoned navigators from the bewildered wanderers, the disciplined from the reckless. By mastering capital management, conquering your emotions, and blazing your own path, you can turn the paradox into your compass. So, embrace the labyrinth’s intricacies, trade with unwavering discipline, and remember, in the grand labyrinth of the forex market, the greatest paradox of all is not the market’s behavior, but your own ability to navigate it with grace.

Bonus Tip: Never underestimate the power of a stop loss and fundamental analysis to identify long-term trends. It may seem like a temporary setback, but in the great labyrinth of the market, it is often the first step to victory.

Happy trading

may the pips be ever in your favor!