Weekly Technical and Fundamental Analysis of Gold – February 4rd:

Last week, the global gold ounce gathered momentum and managed to reach its highest level since early January 2024, around $2065. However, shortly before the end of the workweek, it gave back some of its profits and ultimately closed the week at $2039.

Now, in the upcoming week, in the absence of high-importance economic news, gold could be influenced positively or negatively by the statements of the US central bank officials.

Events from last week in the gold market:

Last week, with the start of the Forex trading day due to heightened geopolitical tensions and a decline in the yield rate of US ten-year treasury bonds, global gold rose by about 0.69% to around $2037.

The news of an unmanned aerial attack on a US base near the Jordan-Syria border that resulted in three deaths and over 20 soldiers being injured raised concerns about escalating crises in the Middle East.

On Tuesday, a day before the official meeting of Federal Reserve officials, gold initially rose to around $2048 but then gave back a significant portion of its gains.

Finally, Wednesday arrived, the day when the market awaited the first Federal Reserve meeting of 2024.

As expected, on Wednesday, the Federal Reserve left its interest rates unchanged within the range of 5.25% to 5.5%.

Then, during the reading of the Federal Reserve statement, an interesting and rare event occurred; Jerome Powell, the head of the US central bank, for the first time changed his tone and did not use the repetitive phrase “we will increase interest rates if necessary.”

Usually, Powell in previous meetings always said that my colleagues are examining future economic indicators to see how interest rates should continue to rise.

Instead, the Federal Reserve of the United States said they will continue to monitor the “implications of received information for the economic outlook” in order to assess their banking decisions.

The initial reaction to the tone of the Federal Reserve caused the US dollar to come under downward pressure and helped XAU/USD to rise.

Then another interesting event happened; Jerome Powell, in a press conference after this meeting and in response to a reporter’s question about the possibility of reducing interest rates in the future, said: Based on today’s meeting, I don’t think we will reduce interest rates in March.

Following remarks from Powell, key Wall Street indices plummeted, the US dollar began to strengthen, and gold, which had been rising strongly, began to decline and gave back a large portion of its profits to the market.

Powell also admitted that if unexpected weakness is observed in the job market, he and his colleagues can reduce interest rates sooner.

Following the turbulent market changes that were seen after the consequences of the Federal Reserve meeting in the market, on Thursday, the yield on US Treasury bonds moved lower, causing an increase in the price of gold.

In fact, the yield on 10-year US Treasury bonds lost more than 2% and after uninspiring employment sector data in America fell to its lowest level since late December, namely below 3.9%.

This caused global gold to rise above $2060.

Then Thursday arrived; the day the market awaited the weekly initial jobless claims report from America.

The US Department of Labor reported that for the week ending January 27th, there were 224,000 initial claims for unemployment benefits, which was higher than the market’s expectation of 212,000.

Additionally, ISM Manufacturing PMI rose from 47.1 in December to 49.1 in January, and the employment index decreased from 47.5 to 47.1.

Finally, Friday arrived; the day the market awaited important US job reports or NFP.

According to the latest reports, it was revealed that non-farm payrolls in the United States increased by 353,000, surpassing the market’s expectation of 180,000 by a significant margin! In fact, November’s figure of 216,000 also increased to 333,000.

Furthermore, annual wage inflation, measured by changes in average hourly earnings, also increased by 4.5%.

The yield on 10-year Treasury bonds also began to return above the important level of 4% in response to this news, causing global gold to start declining towards around $2027.

Events in the forex and gold market next week:

On Monday, the ISM Institute is scheduled to release the Purchasing Managers’ Index (PMI) for the US services sector. If there is no significant difference in the reading of PMI, which is expected to increase from 50.6 in December to 52.0, investors may not react to the labor component.

The employment index sharply decreased from 50.7 in November to 43.3 in December, indicating a contraction in wages and salaries in the services sector. It should be noted that further decrease in this sub-index could have a negative impact on the US dollar, while improvement towards or above 50 could help the dollar find buyers.

However, despite all this, market reactions may remain short-term after the January job market report.

Our forex calendar for the continuation of next week does not show any important news that could have a significant impact on the value of gold and the US dollar. Instead, traders will keep an eye on important statements from members of the US central bank.

The popular interest rate predictor tool CME Group, even though Powell announced that there is no plan to reduce interest rates in March, is still showing that about 20% of market participants believe that the Federal Reserve will cut rates in March.

The current market situation indicates that if Federal Reserve officials once again hint at a possible reduction in interest rates next week, the US dollar will have more room to rise.

But if next week Federal Reserve officials open the door to reducing interest rates in March, the US dollar will come under downward pressure and gold will start to strengthen.

However, the last scenario seems unlikely due to the very strong figures in the US job market.

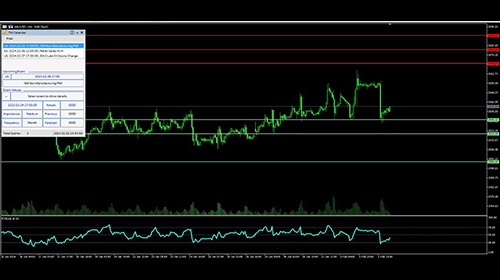

Weekly Gold Technical Analysis: Overall Look at the Global Gold Ounce:

The overall market picture on the daily timeframe is bullish.

The price floor and ceiling for gold last week were $2018 and $2065. If you open the daily gold chart right now and plot an RSI indicator, you will see that the indicator’s peak is pointing downwards and showing a value of 52.

Fortunately, the trend for gold was bullish last week, and the recent market decline on the last trading day is only a temporary correction from a technical standpoint, unless gold starts to experience further declines next week.

Key Support Levels in Global Gold Ounce Analysis:

If gold is to decline, the first significant support level will be the important area of $2030. If gold breaks below this area, the next key price level is $2020. If market bears push gold lower, the next important level will be $2000.

Key Resistance Levels in Global Gold Ounce Analysis :

If gold increases, the first important resistance level will be $2060. If gold successfully surpasses this area, the next key level is $2070. If market bulls manage to push the price of gold higher, the next resistance levels will be $2080 and $2090.

Happy trading

may the pips be ever in your favor!